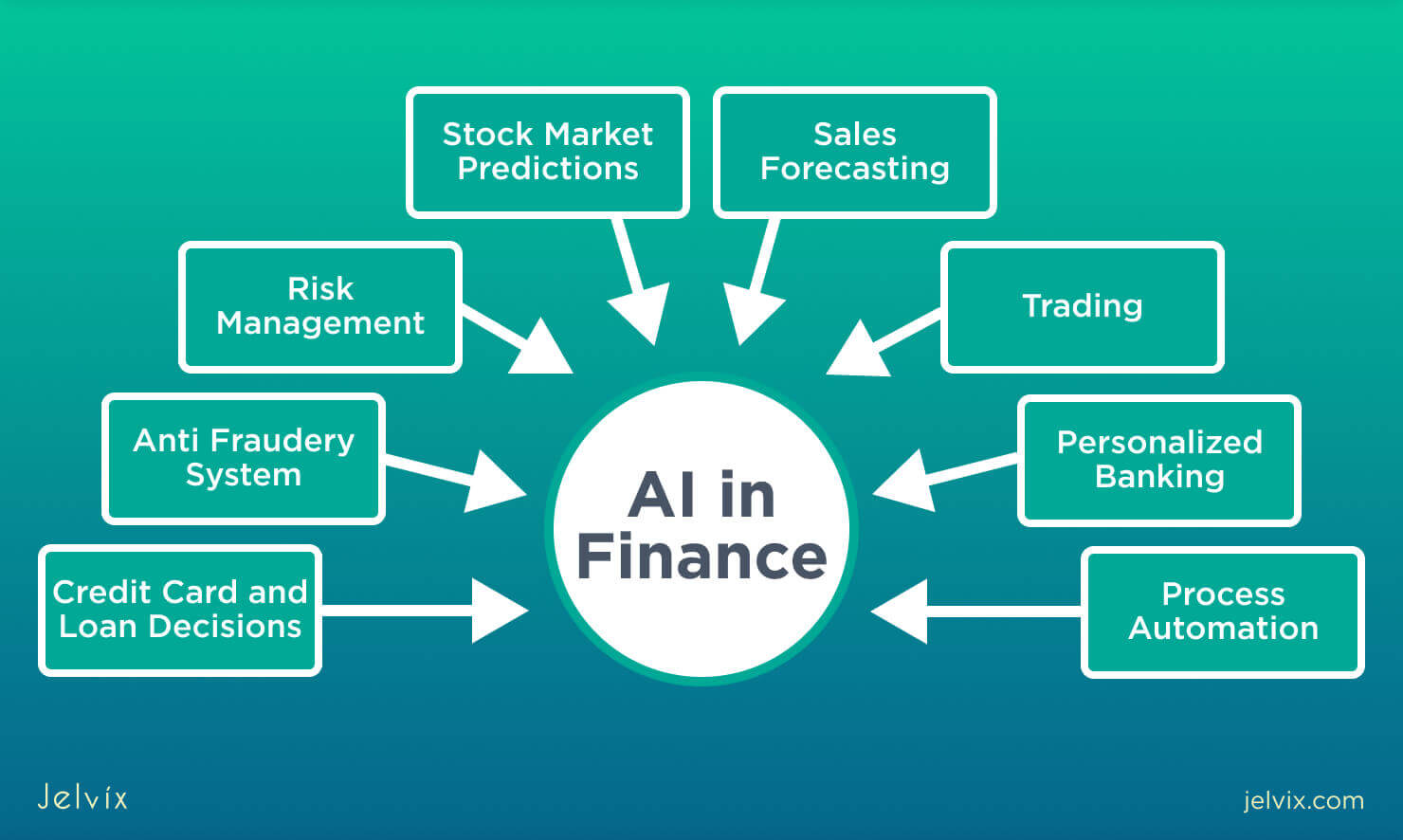

In today’s digital age, advancements in artificial intelligence (AI) are revolutionizing various aspects of our lives, including how we manage our personal finances. From budgeting and investing to debt management and financial planning, AI-powered tools and technologies are reshaping the way individuals approach their financial well-being. In this blog post, we’ll explore the evolving role of artificial intelligence in personal finance management and the benefits it offers to individuals seeking to achieve their financial goals.

- Automated Budgeting and Expense Tracking: One of the primary benefits of AI in personal finance management is its ability to automate budgeting and expense tracking processes. AI-powered budgeting apps and platforms analyze your spending habits, categorize transactions, and provide insights into your financial behavior in real-time. By leveraging machine learning algorithms, these tools can identify patterns, detect anomalies, and offer personalized recommendations for optimizing your budget and saving money.

- Intelligent Financial Planning and Advice: AI-driven financial planning tools provide personalized recommendations and advice based on your unique financial situation, goals, and risk tolerance. These platforms use algorithms to analyze vast amounts of financial data, market trends, and economic indicators to generate tailored investment strategies, retirement plans, and debt repayment schedules. Whether you’re planning for retirement, saving for a major purchase, or paying off debt, AI can help you make informed decisions and optimize your financial plan for long-term success.

- Smart Investing and Portfolio Management: AI-powered investment platforms and robo-advisors offer automated investment solutions that leverage machine learning algorithms to build and manage diversified investment portfolios. These platforms analyze your financial goals, time horizon, and risk profile to recommend a customized portfolio of stocks, bonds, and other assets. By continuously monitoring market conditions and adjusting portfolio allocations accordingly, AI-driven investment tools aim to maximize returns while minimizing risk and volatility.

- Fraud Detection and Security: AI technologies play a crucial role in enhancing the security of personal finance management by detecting and preventing fraudulent activities. AI-powered fraud detection algorithms analyze transaction data, user behavior patterns, and historical trends to identify suspicious activities and flag potential fraud in real-time. By leveraging advanced analytics and machine learning techniques, financial institutions can protect their customers’ accounts and assets from unauthorized access and fraudulent transactions.

- Personalized Financial Education and Insights: AI-powered financial education platforms offer personalized learning experiences and insights to help individuals improve their financial literacy and make better-informed decisions. These platforms use predictive analytics to identify users’ knowledge gaps, preferences, and learning styles, delivering customized content, tutorials, and quizzes to enhance their understanding of key financial concepts. By empowering individuals with the knowledge and skills to manage their finances effectively, AI-driven financial education tools can promote financial wellness and resilience.

Conclusion: Artificial intelligence is transforming personal finance management by automating routine tasks, providing personalized recommendations, and enhancing decision-making capabilities. From budgeting and expense tracking to investment management and fraud detection, AI-powered tools and technologies offer a wealth of benefits to individuals seeking to achieve their financial goals and build long-term wealth. As AI continues to evolve and become more integrated into our daily lives, it’s essential for individuals to embrace these innovations and leverage them to optimize their financial well-being. By harnessing the power of AI, individuals can take control of their finances, make smarter decisions, and pave the way to a brighter financial future.